Stock Predictions for Happiest Minds Technologies: 2025 to 2050

Introduction to Happiest Minds Technologies

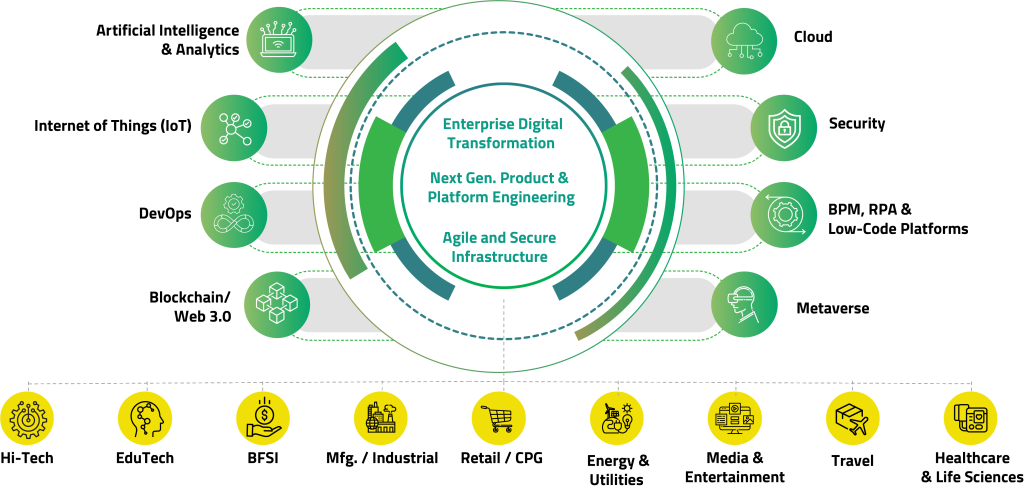

Happiest Minds Technologies is an Indian IT service and product company focused on digital business, product engineering, and infrastructure management. It was established in 2011. The main purpose of the company is to work on the mantra of “Happy People, Happy Customers.”.

Review of the business and development of Happiest Minds

1. Focus on digital transformation:

- The company mainly focuses on digital platforms and modern technologies.

2. Revenue Increase:

- Happiest Minds has recorded a great increase in its revenue over the last few years.

3. Customer base:

-

The company’s customers come from various sectors, including healthcare, BFSI (banking, financial services, and insurance), retail, and manufacturing.

Historical analysis of the stock performance

Happiest Minds was shared on the market in 2020. At the time of its IPO, it gave investors great returns.

Performance of the last 5 years:

- 2020: The share returned 110% in the first year of its launch.

-

By 2023: This stock remains a stable and rising option

- ormation and cloud technology, its share can go up to₹2000–₹2500 by 2025.

Factor:

- AI and the focus on machine learning grow.

-

Extension in the Global Client Base.

2030 Predictions

-

- By 2030, the company will have more detail in the digital sector.

- Estimated stock price: ₹5000–₹7000

-

ion in its industry.

Happiest Minds Stock Prediction 2025

Estimated figures by 2025:

Share Price:

-

- Due to investments in Happiest Minds’ digital transf

Important Development Area:

- Green Technology.

-

quantum computing.

Forecast of 2035

This possibility may be by 2035:

- The share value of Happiest Minds can reach ₹10,000–₹15,000.

- It can be 5% global market share in the digital space.

-

Important Factor: The Company’s R&D investment.

Long-term viewpoint for 2040

For Happiest Minds by 2040:

- Share Price: up to ₹25,000.

-

By this time, the company can be dominated in AI, IoT and blockchain

The 2045 and 2050 landscape

Happiest Minds in 2045 and 2050:

Share price: ₹50,000 or higher.

- The company may be a market leader in the digital sector.

- Possible challenges after 2030:

- Increased competition in the industry.

-

Maintaining pace with new technical innovations.

Suggestions for investing in Happiest Minds

- Adopt a long-term outlook.

- Analysis of the company’s financial performance before investing.

-

Keep in mind market risks.

Conclusion

Can Happiest Minds Technologies become a Multibagger?

The main reason for becoming a multibagar

1. The growing effect of digital technology:

Happiest Minds is mainly focused on digital services, which are going to become essential for companies and industries in the future.

2. Stable Financial Performance:

The company’s revenue and profits are increasing steadily.

3. Global Client Base:

Happiest Minds has strengthened its customer base not only in India but also in the US, Europe, and other parts of Asia.

4. Specialization in latest technologies:

Main milestones for Happiest Minds between 2025 and 2030

1. Increase in revenue rapidly

- Happiest Minds target by 2025 could reach revenues of ₹10,000 crore.

-

Factor:

- connecting new customers.

- increased demand for digital services.

2. Extension to new markets

- Between 2025 and 2030, Happiest Minds can expand its business in new geographical areas such as South America, Africa, and Central Asia.

3. New Products and Services

- By 2030, Happiest Minds can become the leading in these areas:

- AI-Driven Solutions: Smart Business Solutions with Machine Learning and Artificial Intelligence.

-

Green Technology: An environmentally friendly digital solution.

4. Large Tech Partnerships

- By 2030, Happiest Minds can make new partnerships with large tech companies (such as Microsoft, AWS, and Google).

5. Investing in R&D

-

The company will focus more on research and development, thereby expanding its product portfolio.

Will Happiest Minds become a multibagger by 2030?

Stock of Happiest Minds between 2025 and 2030:

- Estimated CAGR: 25%–30%

-

Share Price:

- By 2025, it can reach ₹2000–₹2500 and ₹5000–₹7000.

-

If the company effectively implements its growth strategy and maintains pace with the changing demands of the market, it can definitely give investors a multibagar return.

Conclusion

Investment in Happiest Minds Technologies can be a great opportunity, especially for investors who have a long-term outlook. The company’s development between 2025 and 2030 will also reflect its share price. However, do intensive analysis of the company’s financial performance and market situation before investing.

Happiest Minds generative AI (Gen AI) Business Unit and its impact on the future

Gen AI Business Unit: The strategy of Happiest Minds

1. Focus on rising AI solutions

- Happiest Minds has designed the Gen AI Business Unit to work in areas where data is needed, processing, and automation.

-

Purpose:

- Providing businesses fast, efficient, and cost-effective AI solutions.

- Increase customer experience and improve production processes.

2. Industry-specific solution

The Gen AI Business Unit is developing customized AI solutions for various industries, such as:

- Healthcare: Improve smart diagnostics and patient care.

- Finance: Frod detection and real-time data analytics.

-

Retail: Personalized Marketing and Inventory Management.

3. Product and platform development

-

The Gen AI Unit is working on new products and platforms, which will help make businesses more productive using artificial intelligence.

The effect of Gen AI on the growth of Happiest Minds

1. Increase in revenue

The growing use of Gen AI can increase the income of Happiest Minds between 2025–2030.

Estimated Contribution:

- The Gen AI Business Unit can contribute 30%–40% of the company’s total revenue by 2030.

2. Competitive advantage in the market

Happiest Minds has adopted AI as its main column, making it in a better position than other IT companies.

Advantage: Leading places in the field of AI and automation.

Extension of partnerships with big tech companies and startups.

3. New customers and market

Gen AI Business Unit will help the company deliver new markets and customers.

Example: The increasing demand for global AI solutions will help Happiest Minds achieve more projects in the US, Europe, and Asia.

4. Innovation and R&D

Happiest Minds’ focus on R&D, especially in AI and machine learning, will enable it to launch new products and services.

5. Long-term viewpoint

Challenges coming through Gen AI

1. Technical competition

- Many large companies are already working in the area of AI, like Google and Microsoft.

- Happiest minds must show themselves separate through their expertise and customized services.

2. Data security and privacy

- Data security can be a big issue in providing AI-related solutions. The company must ensure high-level data privacy.

3. Efficient talent required

Conclusion

Happiest Minds’ Gen AI Business Unit is an important column of the company’s future growth. This unit will not only provide the company with new revenue sources but also give it competition globally.

Qes\Ans

What is the future of happiest minds technologies?

happiest minds technologies share price target 2030

happiest minds, technologies share price screens

happiest minds future target

is happiest minds good for long-term