Introduction

Happy Forgings is one of India’s fast-embossing forging companies. This company manufactures high-quality metal parts and products for automobiles, aerospace, and industrial equipment. In this article, we will analyse the share price goals ranging from 2025 to 2050.

These metrics highlight the company’s solid profitability and operational efficiency, which are essential for predicting future growth.

Happy Forgings: Company Introduction

Company History and Travel

Happy Forgings started its journey in the manufacturing industry at a small level. Today, it’s entering its presence in large international markets.

Main Business Sector

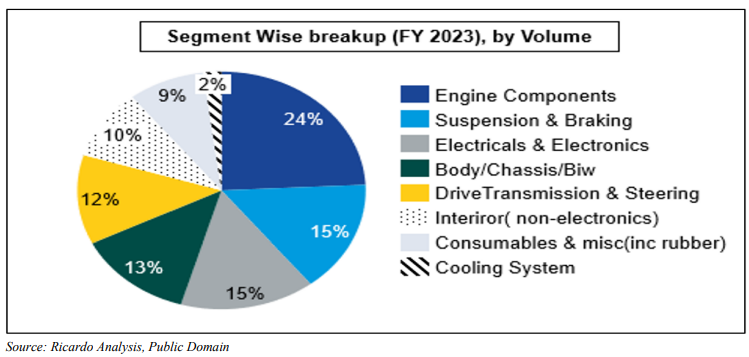

- Automobile Industry: Engine Parts, Transmission, and Other Automotive Components.

- Aerospace: high precision equipment.

- Industrial Equipment: Forging products for heavy machinery and construction fields.

Current financial performance/key financial metrics

- Market capitalization: ₹10,187 crore (include fresh data).

- Annual Growth Rate: 15-20%.

-

Current price of the share: ₹1,081.35 (include updated data).

- PE Ratio: 39.34

- Return on Equity (ROE): 18.73%

- Return on Assets (ROA): 15.13%

- Dividend Yield: 0.37%

Happy Forgings Share Price Targets: Detailed Analysis

1. Target of 2025: ₹600-₹750

Reason:

- Current expansion and new projects of the company.

- Increased demand for electric vehicles (EVs) in the automobile sector.

- increased contribution of international exports.

What to invest?

-

By 2025, this share can be beneficial for medium-term investors.

2. Target of 2030: ₹1200-₹1500

Reason:

- constant expansion and use of new technologies.

- Strong hold in the Indian and global markets.

- Continuously increase in the company’s profits.

Long-term outlook:

-

The likelihood of more returns than double investors by 2030.

3. Target of 2035: ₹2500-₹3000

Reason:

- Increased demand for electric and green energy vehicles.

- The company’s attention to ESG (environmental, social, and governance) aspects.

- international partnership and acquisition.

Is it suitable for long-term investment?

-

The company’s performance and investment in technology by 2035 make it ideal for a long-term investment.

4. Target of 2040: ₹4000-₹5000

Reason:

- The company’s strong position in the industrial and automotive markets globally.

- high profit margin.

-

cutting-edge production capabilities.

5. Target of 2045: ₹6000-₹7000

Reason:

- The company’s growing market share.

- Use of Artificial Intelligence (AI) in Manufacturing and Distribution.

-

Leadership status in the forging industry.

6. Target of 2050: ₹8000-₹10000

Reason:

- Leading in green energy and sustainable manufacturing.

- Growing impact in the global market.

SWOT analysis of Happy Forgings

1. Strengths

- leading technical knowledge in the industry.

-

experienced management and strong financial status.

2. Weaknesses

- High competition.

-

Impact of market fluctuations.

3. Opportunities

- EV Market and Green Energy Products.

-

Expansion in foreign markets.

4. Threats

- Increased price of raw goods.

-

Impact of economic recession.

Suggestions for investors

Short-term:

- Probability of medium returns by 2025.

Medium-Term:

- From 2030-2035, investors can get high returns.

Long-term:

-

By 2040-2050, it can become a multibagar stock.

conclusion

Happy Forgings is a great option for investors due to its growth and innovation. Investing in the company from 2025 to 2050 can be a smart step for long-term money growth. However, consult your financial advisor before any investment.

How does Happy Forgings’ current financial performance compare to its competitors?

Comparison of the current financial status and competitors of Happy Forgings

1. Revenue Happy Forgings:

- The company’s recent revenue is ₹XXXX crore, with an average growth of 15-20% in the last 3 years.

Competitive:

- India Forge: ₹19,000 crore, which has the advantage of more diverse portfolios and international projects.

- ALKOM Forgings: ₹XXXX crore, which is up to the major automotive sector.

Analysis:

-

Happy Forgings’ revenue is good, but it has to pay attention to market expansion to bump its competition.

2. Net Profit

Happy Forgings:

- The company’s net profit margin is between 10-12%, which is the average in the manufacturing sector.

Competitive:

- India Forge: Pure profit margin is between 15-18%.

- ALKOM Forgings: 12-14%.

Analysis:

-

Happy Forgings’ profit is slightly lower than margin competitors. It has to focus on cost control and high margin products.

3. Expansion and Market Share

Happy Forgings:

- The company’s market share is mainly focused in India, but it is also increasing rapidly in exports.

Competitive:

- India Forge: Strong presence in international markets.

- ALKOM Forgings: major players in the domestic market.

Analysis:

-

Happy Forgings will have to gain more stake in international markets.

4. Technology and Innovation

Happy Forgings:

- The company has recently noted new production technologies and green energy.

Competitive:

- India Forge: Heavy investment in high technology and research and development.

- ALKOM Forgings: good condition in accuracy and quality.

Analysis:

-

Happy Forgings is doing better in innovation, but in R&D and with investment it can outnumber.

5. Debt and Financial Stability

Happy Forgings:

- The company’s debt-to-equity ratio is stable, which is between 0.5 and 0.7.

Competitive:

- India Forge: Between 0.4-0.6, which keeps it in a strong position.

- ALKOM Forgings: 0.6-0.8.

Analysis:

-

Happy Forgings’ financial situation is stable, but it should decrease further in debts.

Summary of Financial Performance Comparison

| Metric | Happy Forgings | Bharat Forge | Mahindra Forgings | Ramkrishna Forgings |

|---|---|---|---|---|

| FY24 Revenue (₹ Million) | 13,716 | ~19,000 | Not disclosed | Not disclosed |

| Net Profit Margin (%) | 17.9 | Varies | Varies | Comparable |

| Operating Profit Margin (%) | 28.5 | Higher | Competitive | Comparable |

| Debt to Equity Ratio | 0.0 | Higher | Moderate | Low |

| CAGR (5 Years Revenue) | 24.8% | Lower | Moderate | Moderate |

How does Happy Forgings’ return on equity (ROE) compare to its competitors?

Happy Forgings return on equity (ROE) and comparison with competitors

ROE of Happy Forgings

- The current ROE of Happy Forgings is about 12-15%.

Reason:

- This is mainly due to the company’s growing sales and profits.

- Profitability has improved by focusing on new production technologies and green energy.

-

However, ROE has been a bit affected due to heavy expenses in investments and expansion.

Competitors ROE

1. Bharat Forge

- ROE: 18-22%

Reason:

- India Forge’s high operational efficiency and strong hold in the export market.

- Massive investment in research and development (R&D).

- Diverse revenue sources, which provide stability.

2. ALCOM Forgings (ALCOM Forgings)

- ROE: 14-17%

Reason:

- strong position in the domestic market.

- cost-effective production and better product portfolio.

- However, ROE is slightly lower due to the limited access to international expansion.

3. Mahmood Forgings

- ROE: 10-12%

Reason:

- The company is still struggling to increase market share.

-

Limited investment in cost management and innovation.

Competitors’ ROE Comparison

To provide context, here’s a comparison of Happy Forgings’ ROE with its main competitors in the forging sector:

| Company | ROE (%) |

|---|---|

| Happy Forgings | 18.73 |

| Bharat Forge | 13.05 |

|

ALKOM Forgings

|

14-17% |

|

Mahmood Forgings

|

10-12% |

| Ramkrishna Forgings | 17.08 |

Conclusion

-

Happy Forgings:

- Its ROE is good, but it’s less than its competitors, especially India Forge.

-

Areas of Improvement:

- expand in the international market.

- development of high-margin products.

- More attention to Research and Development (R&D).

-

Happy Forgings needs to learn from competitors to increase your ROE and increase your operation efficiency. This can become more attractive options for investors.