ETF vs. Mutual Fund: Who’s Better?

Preface: How to choose the right option in the world of investment?

When it comes to investment, investors are often confused about whether they should invest in a mutual fund or in an ETF (exchange-traded fund). Both are the best investment options, but they are quite different from each other. In this article, we will discuss the differences between the mutual fund and the ETF, their advantages and disadvantages, and who should choose.

What are mutual funds and ETFs?

What is a Mutual Fund?

A mutual fund is an investment instrument where many investors invest their money together. This money is put in stocks, bonds, or other assets by professional fund managers. It is suitable for investors investing for the long term.

Main Features:

Active management by the fund manager.

Start with the minimum investment amount.

The option of SIP (Systematic Investment Plan).

What is ETF?

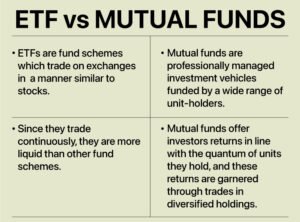

ETF (Exchange-Traded Fund) is a fund that is bought and sold in the stock market, like stocks. These usually track a particular index (such as Nifty or S&P 500) and offer a good investment option at a low cost.

Main Features:

Trade is in the market like stock.

more transparency.

inactive management.

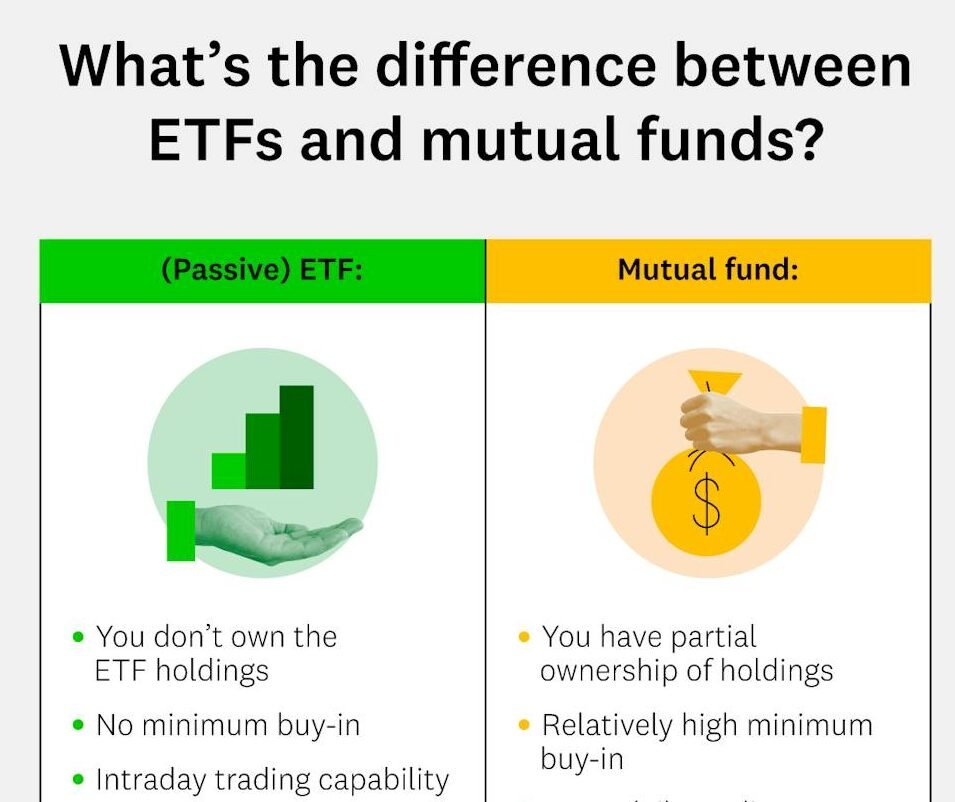

Trading and Liquidity

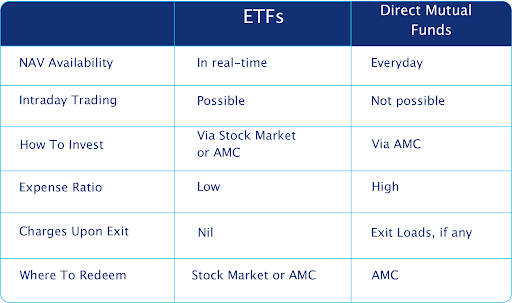

ETF: You can buy and sell them in the stock market all day, and their price varies according to market demand and supply.

Mutual Funds: These can only be bought and sold at their net asset value (NAV) at the end of the day.

Cost and Fees

ETF: These include expense ratios (management fee). However, there is a brokerage fee on each trade.

Mutual funds: Their expense ratio can be higher, especially for actively managed funds.

Management Style

ETF: These are inactively managed and typically track an index.

Mutual Funds: These are actively managed and fund managers attempt to give better returns from the market.

Benefits and Disadvantages of Mutual Fund

Advantages of Mutual Funds:

Professional Management: Expert Fund Managers manage your money.

Diversification: Investing in various assets can reduce risk.

SIP Options: A big amount can be raised by investing small-scale.

Mutual Fund Disadvantages

High fees: Active funds have higher management fees.

Low Transparency: Where the investment is happening, it doesn’t fully know.

Liquidity deficiency: Trading is possible only at the end of the day.

Advantages and Disadvantages of ETF

Advantages of ETF:

Low-cost options: Cheap due to low express ratio and inactive management.

Flexibility: facility of day-long trading in the market like stocks.

Transparency: The structure of the portfolio is always clear.

Disadvantages of ETF:

Brokerage fees: Brokerage is required to be given every time buy and sell.

Complexity: It may be a bit hard for beginner investors to understand it.

Dividend Automation: Dividend has to make a manual effort to reinvest.

Who’s better for investors: ETF or Mutual Fund?.

If you are an initial investor and want professional management:

A mutual fund is better for you. By investing a small amount through SIP, you can get good returns in the long term.

If you are an active trader or are looking for a low-cost option:

ETF is better for you. This is for investors who can keep an eye on the market and make trades from time to time.

Conclusion: ETF vs Mutual Fund

ETF and Mutual Fund both have their advantages and disadvantages. Choosing the right option depends on your needs, risk tolerance, and financial goals. If you want low costs and flexibility, ETF may be correct. At the same time, if you want professional management and an easy investment process, the mutual fund would be suitable.

What is the difference between Mutual Fund and an ETF? Who’s the better option?

Preface: Welcome to the world of investment

The first question comes when you step into the investment world: Which of the Mutual Funds or ETFs is better?

Both are popular investment options, but there are significant differences between them. This article will explain the difference between the mutual fund and ETF in detail, so you can choose the right option for your investment.

What are Mutual Funds and ETFs?

Mutual Fund:

Mutual Fund is an investment instrument where multiple investors’ money is levied in stock, bonds, or other assets. This fund is operated by a professional fund manager.

Main Features:

- professional management.

- suitable for long-term investment.

-

Ideal choice for small investors.

ETF (Exchange Traded Fund):

ETF is a fund that trades like shares on the stock exchange. It tracks an index (such as Nifty 50) and is an attractive choice of investment at a low cost.

Main Features:

- trading like stocks.

- low management fees.

-

transparency more.

3 Main differences between Mutual funds and ETF

Trading Process and Liquidity

- Mutual Fund: Mutual Fund can only be bought or sold at its NAV (Net Asset Value) at the end of the day.

-

ETF: ETF can be bought and sold all day like stock.

Management and Costs

- Mutual Funds: These are actively managed, where the fund manager tries to give your investment the maximum benefit. Due to this, the expense ratio is higher.

-

ETF: Most ETFs are inactively managed, which only track one index. Due to this, the expense ratio is reduced.

Dividend and Reinvestment

- Mutual Fund: A dividend can be received automatically in a mutual fund.

-

ETF: In ETF, the dividend investor deposits directly into the account, and for reinvestment it has to manual.